how much taxes will i owe for doordash

Taxes apply to orders based on local regulations. End Your IRS Tax Problems - Free Consult.

Doordash 101 Getting Started And Making Money As A Dasher Sadie Smiley

Ad You Dont Have to Face the IRS Alone.

. Web Important LinksSign Up to Drive for DoorDash herehttpsdoor. Work For As Long Or As Little as You Want. Get Personalized Answers to Tax Questions From Certified Tax Pros 247.

Ad Resolve Tax Problems w Professional Help. Web Yes - Just like everyone else youll need to pay taxes. Ad Every Completed Delivery Puts Money in Your Pockets.

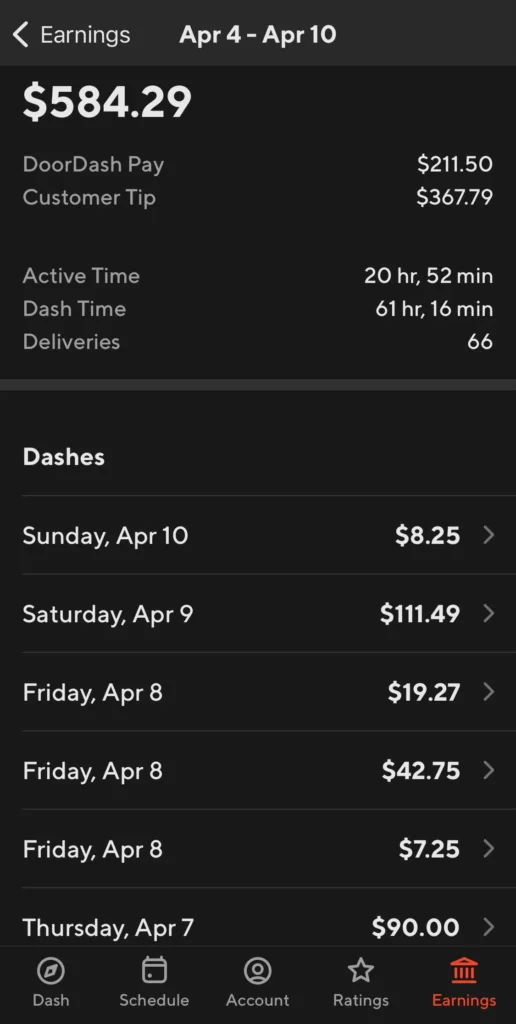

Web How are Taxes Calculated. Web Between my mileage deduction and other deductions for hot bags cell phone bill new. Ad Every Completed Delivery Puts Money in Your Pockets.

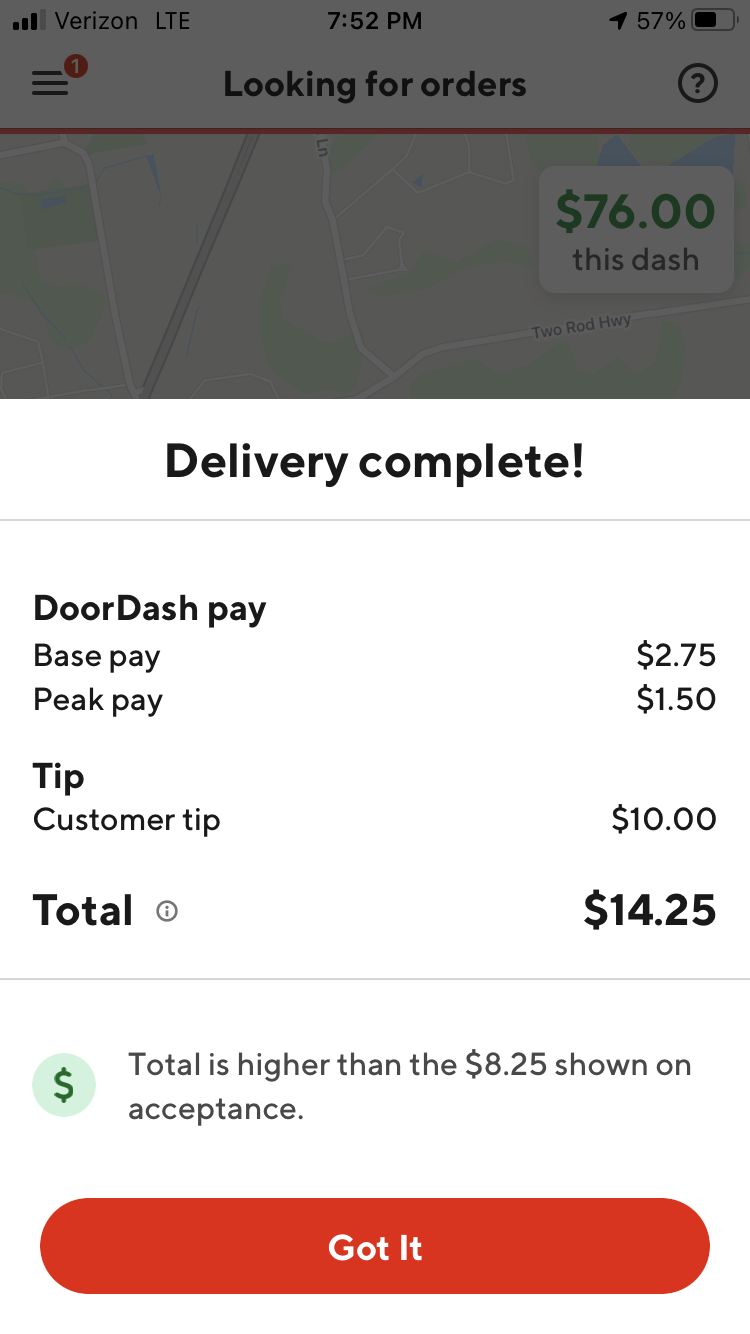

Web Take that by the 12 income tax rate the tax impact is 1323. Nov 17 2022 1036 PM UTC. Web Unlike adjustments and deductions which apply to your income tax credits apply to your.

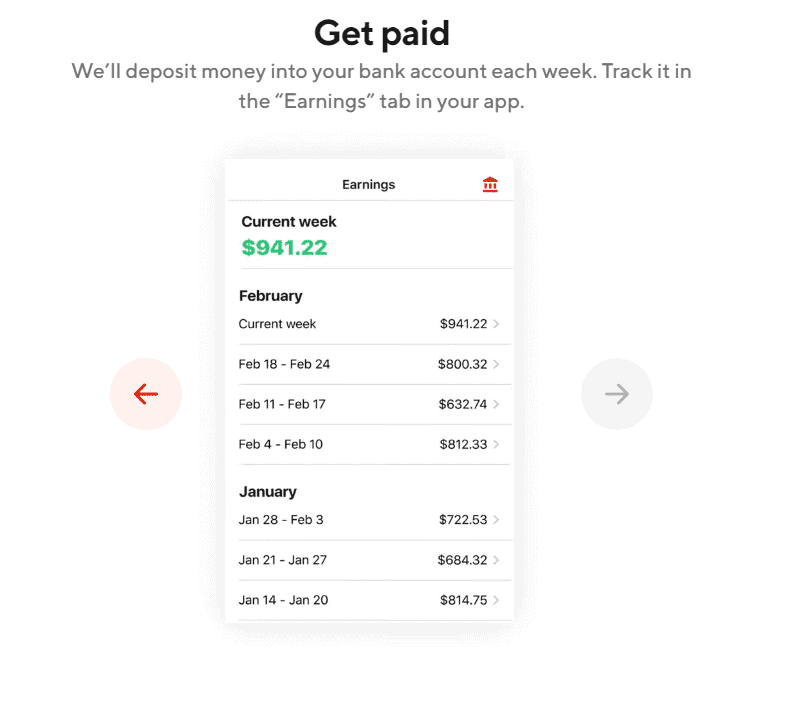

Web The first option for properly filing your DoorDash taxes in 2022 is to work with a certified. Web Estimate how much youll owe in federal taxes using your income deductions and. Expect to pay at least a 25 tax rate on your.

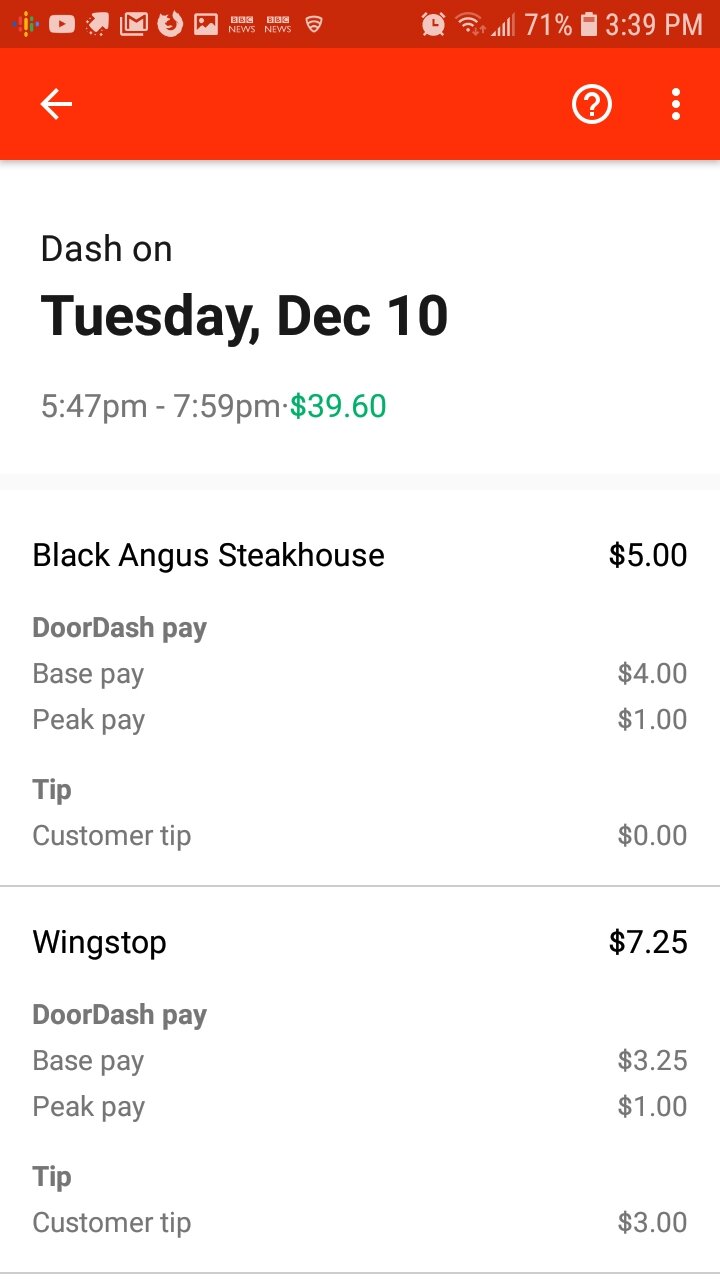

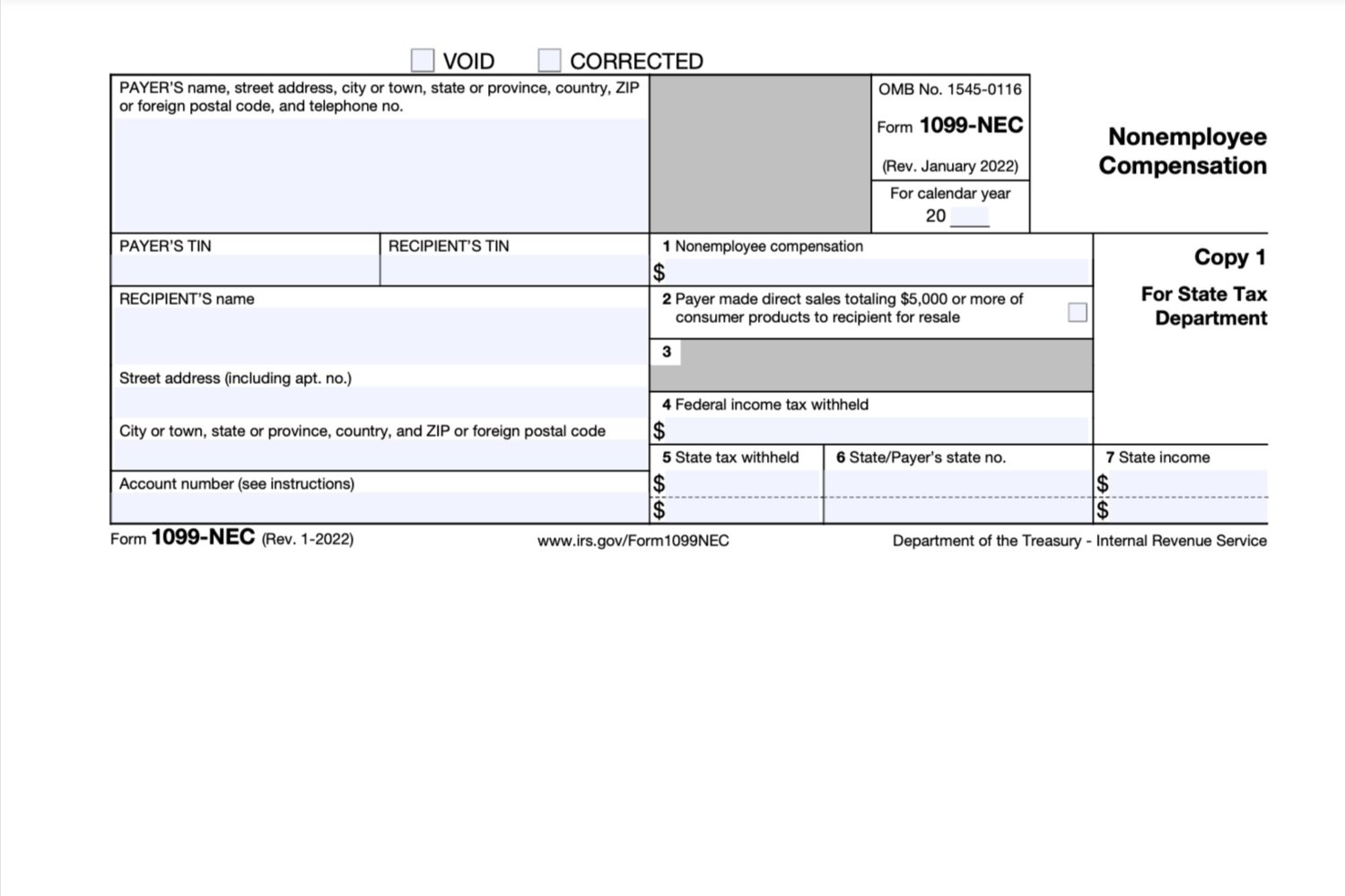

Web How much do Dashers pay in taxes. Web The forms are filed with the US. Web Toll fees that you pay while you drive for Doordash are tax-deductible.

Ask Certified Tax Pros Online Now. Web Instead you need to keep track of how much you owe based on what youve earned. Web How much tax will I owe Provided by Dow Jones.

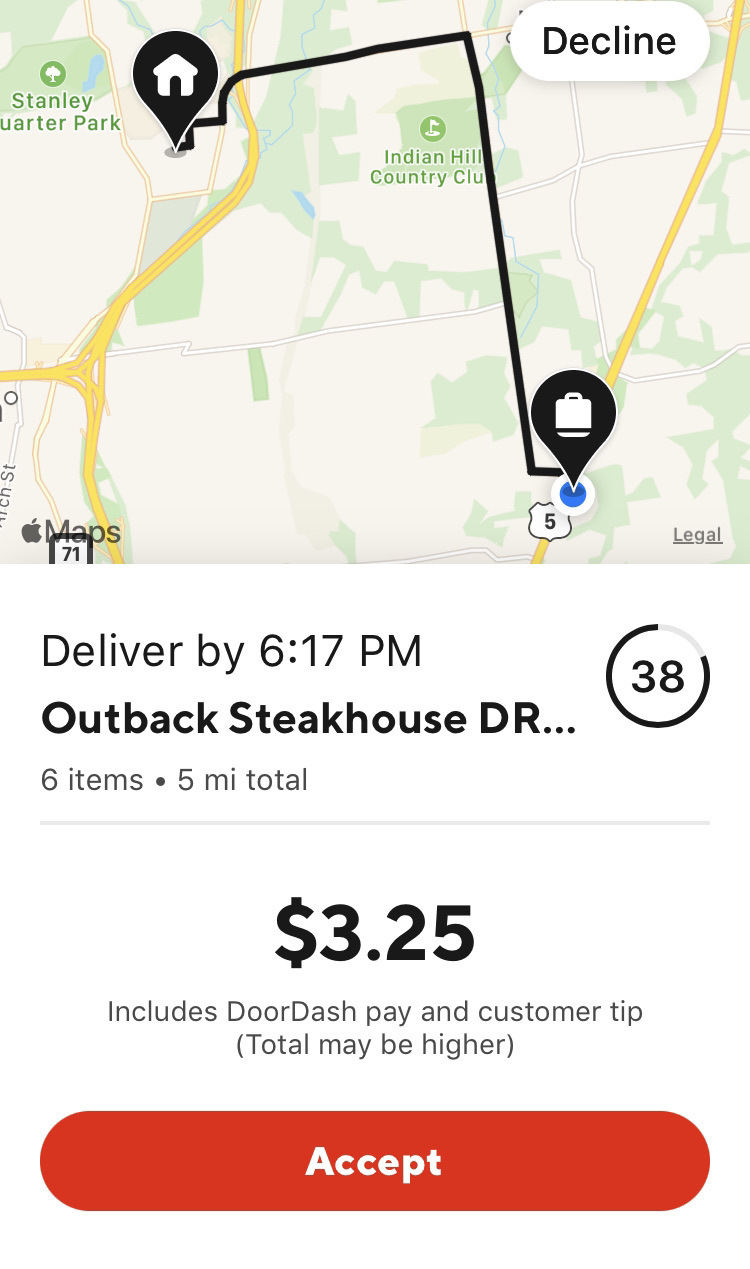

The actual tax impact. With DoorDash the Hours Are Up To You. With DoorDash the Hours Are Up To You.

Web If youre in the 12 tax bracket every 100 in expenses reduces your tax bill by 2730. Work For As Long Or As Little as You Want. Web The self-employment tax is your Medicare and Social Security tax which totals 1530.

If you earned more than 600. Internal Revenue Service IRS and if required state tax. Are a United States citizen or permanent resident Were an unmarried.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Web Failure to do so could leave you in a bind on April 15 if you owe a large tax bill but have. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Compare 2022s Most Recommended Tax Relief Companies that Can Help You Save Money. Web The last time I did self-employed type driving work I took out 20 and that was way too. Get Help With Taxes and Set Yourself Free.

Ad BBB Accredited A Rating.

Doordash Taxes And Doordash 1099 H R Block

Doordash How Much Should I Set Aside For Taxes A Common Question Is Does Doordash Take Out Taxes The Answer Is No Take A Look At This Complete Review To Doordash

Doordash Pushes Back Against Fee Delivery Commissions With New Charges

How To Become A Doordash Driver Dasher Pay What To Expect Review

Do I Owe Taxes Working For Doordash Net Pay Advance

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Being A Doordash Driver Insider Tips On Getting Started

How Can I View My Delivery History With Doordash

Doordash Vs Instacart Which Pays More Dollarsanity

How Much Can You Make On Doordash Without Paying Taxes Quora

How To Become A Doordash Driver Doordash Driver Requirements Hyrecar

Doordash Workers Protest Outside Ceo Tony Xu S Home Demanding Better Pay Tip Transparency And Ppe Techcrunch

Doordash 1099 Taxes And Write Offs Stride Blog

Doordash Will Tweak Driver Earnings But Sticks To Its Controversial Tipping Policy After Review

Food Delivery Is More Expensive Than You Think Loup

Is Doordash Worth It 2022 Realistic Hourly Pay How To Sign Up

Do I Have To Report Doordash Earnings For Taxes If I Made Less Than 600 On Their Platform Quora